After the Ethereum Merge, ETH became a proof-of-stake cryptocurrency paving the way for Dogecoin to be the second biggest Proof-of-Work Coin.

Ethereum becomes a Proof-of-Stake Cryptocurrency.

On 15 Sept 2022, Ethereum successfully transitioned to the proof of stake consensus mechanism. Earlier it was operating on the Proof-of-Work consensus mechanism.

A consensus mechanism is a way of validating transactions on the blockchain where multiple parties reach a “consensus” on whether a transaction is valid.

The Proof-of-Work Consensus mechanism validates transactions where each validator(called a miner) runs a certain level of difficult computation to obtain a number. Anyone can become a miner, and there is no restriction on entry. Of course, better hardware means better mining rewards.

The Proof-of-Stake Consensus mechanism validates transactions by having greater”skin in the game“. Each validator stakes(collateralizes) a certain amount of cryptocurrency, enabling them to have a say in the validator network. It is assumed that whoever puts higher collateral becomes a more trusted entity.

What was wrong with Proof-of-Work?

There was nothing legally wrong with the proof-of-work mechanism, but the sole objection was that Proof-of-Work was highly energy intensive. It consumes as much as 10 thousand times more energy than proof of stake due to intense computation.

This was evident when Ethereum reduced 99.99% of energy consumption after transitioning to proof-of-stake.

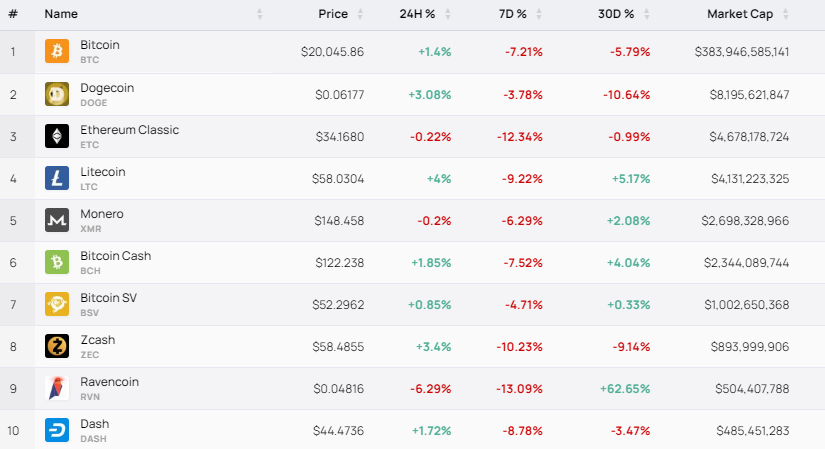

Dogecoin becomes the No. 2 Proof-of-Work Cryptocurrency

Now with Ethereum gone, many cryptocurrencies like USDT and USDC, which relied on Ethereum Blockchain, are also considered proof-of-stake cryptocurrencies because they run on a proof-of-stake blockchain(Ethereum).

This situation makes Dogecoin the second most popular cryptocurrency on a Proof-of-Work Blockchain(Dogecoin has its own Blockchain).

Remember, Dogecoin is based on a slightly modified version of Litecoin, which was itself based on Bitcoin.

Is there any Profit-Making opportunity?

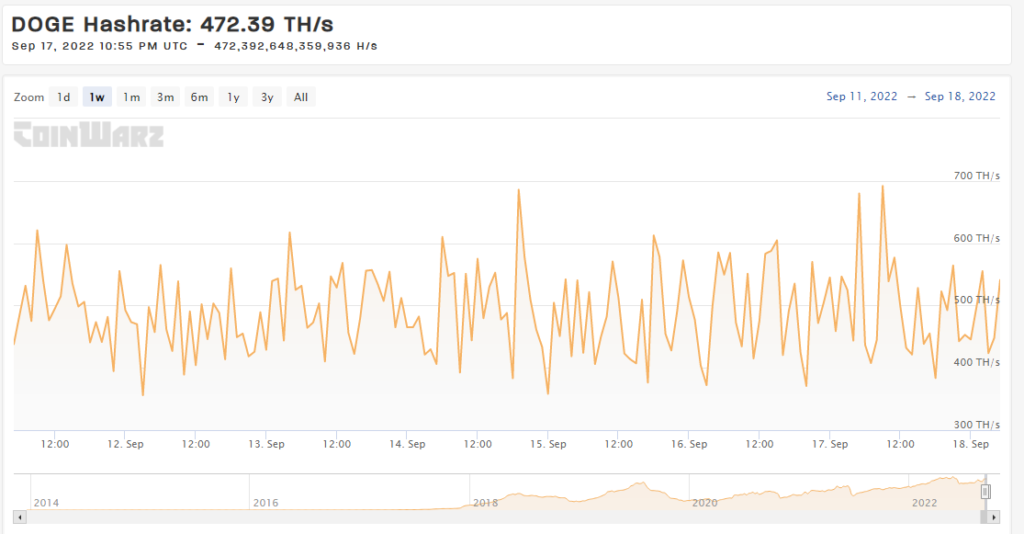

Fundamentally, nothing appears to have changed. The Ethereum prices are more or less around the same level. Dogecoin prices, too, have been almost the same. There has been no surge in transactions or hash rate.

Dogecoin Price Prediction September 2022

On daily charts,

- the RSI is at moderate strength showing an indecisive market.

- MACD is above the trend line but is in the negative zone showing weak price momentum.

- Further Volume has shrunk.

But if the price moves upwards of the $0.087 resistance level, there can be an upwards movement toward $0.17(more than double).

Can DOGE reach $1?

We can only expect a $1 price prediction for Dogecoin by the end of 2030.

The markets are expected to recover as soon as there is a stop to rate hikes by central governments across the world.

These rate hikes are expected to last till the end of 2022. From 2023 Q1, we can expect a slow path to recovery. We are expecting a full market recovery by late 2025.

I am a certified Research Analyst in Equities. My analysis is purely for educational purposes. Cryptocurrencies are volatile and involve significant risk. Kindly trade at your own risk and with the advice of a financial expert.