FTX is an online cryptocurrency exchange founded by Sam Bankman-Fried and Gary Wong. It was registered in Antigua and Barbuda and had its headquarters initially in Hong Kong, PRC. The headquarters were transferred from Hong Kong to The Bahamas following the Chinese regulatory action in September 2021.

As of Dec 2021, it had a staggering US$ 600 billion worth of monthly transactions. Being a popular platform, it has a 3.05% of the market share. It is one of the contenders for the best crypto exchange.

Summary

- Cryptocurrency trading forum/exchange founded by two MIT graduates. Headquarters in The Bahamas.

- Has a daily trading volume of US$ 11 Billion. Claims to be a trading platform built by traders.

- Easy login and registration. Supports 12 languages.

- Has a dedicated support page. A detailed doc page also redirects to a self-help page.

- The Markets section has the Futures, Spot, Tokenized Stocks(through a third party), Leveraged tokens, Volatility, Election Prediction and Fiat Currency.

- There is a separate portal for Over-The-Counter transactions.

- FTX has its own token named the FTT with US$ 3.7 billion worth of supply (marketcap).

- The NFT page has a huge collection of NFTs ranging from common to rare ones.

History:

FTX was incorporated by two MIT graduates, Sam Bankman-Fried and Gary Wong, who currently serve as the Chief Executive Officer and Chief Technical Officer. Before founding FTX, Sam, an MIT Physics graduate, was a trader on Jane Street Capital’s International ETF Desk and designed their OTC trading system. Gary was a software engineer at Google. He graduated from MIT with a degree in Mathematics with Computer Science. They incorporated the company in Antigua and Barbuda, having headquarters in The Bahamas. The FTX Company raised about US$ 900 million in July 2021 from 60 investors, including Softbank, Sequoia Capital, Third Point Management, Paul Tudor Jones, and Alan Howard. Binance, which also was an investor, later withdrew.

Since many governments have now posed a ban or serious regulation on crypto trading, people have resorted to using Virtual Private Networks or VPNs for crypto trading.

Getting Started

Login and Register

Registering on FTX is very easy. One just needs to enter their email and set a password.

You can also directly log in from Gmail or Apple ID.

It is well-advised that the user reads the terms and conditions well before signing up and does not just skip them.

Languages :

When you log in to the platform for the first time, it will set the browser default as the default language.

Language can later change into one of the 13 supported languages, such as Bahasa Indonesia, Chinese, Dutch, Turkish, Russian, Vietnamese, Spanish, Italian, Portuguese, English, and Thai.

Support:

A dedicated support page was well expected in such a big platform. It asks for a login and requests to send a support link to the user, which protects the user’s privacy and shields the platform from unnecessary communication.

- FTX Trading Fees:

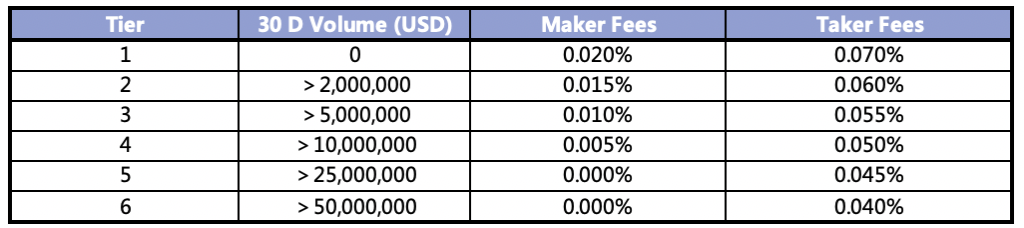

FTX’s trading fee is categorized into six tiers ranging from 0.02% to 0% based on 30-day trading volume. For FTX US trading fees, these are applicable too. Moreover, FTX gives a chance to make zero trading fees by using 25 FTTs.

FTX Fees

#Note: FTX does not support Tron Blockchain tokens i.e. TRC 20 Deposits.

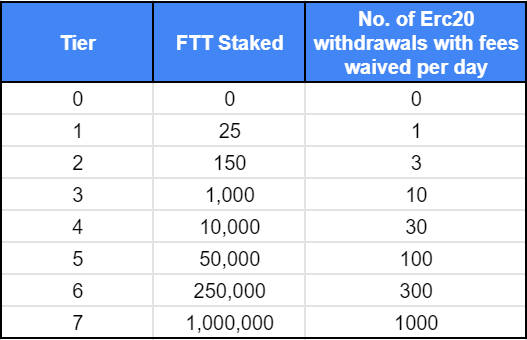

FTX has a unique withdrawal system where you can reduce your withdrawal fees to zero if you have staked FTT(FTX Token). Please note that these withdrawal fee waivers are for coins that are ERC-20 based, and for other coins, fees are as usual.

If you want to reduce gas fees to zero for withdrawals in any exchange, use a token that has almost zero fees, like USDT-TRC20, Ripple Coin(XRP), or Algorand(ALGO).

FTX also has a withdrawal limit based on the tier of KYC done.

Markets

The Markets section is central to the website. It has sub-sections on Futures, Spots, Stocks, Leveraged Tokens, Volatility, FIat, Prediction, and Recent. The overall navigation appears to be easy, and new users should not face many issues in navigating to different sections or subsections.

My personal favourite is the Spot Section. The section is so designed that even for non-intuitive persons like me, the page is fairly easy to navigate.

Note: You will read the word CONTRACT often in this article. Contracts, here, mean an agreement between two persons, here unknown, who have agreed to pay each other if the direction of the underlying(crypto, future, or option) moves against their predicted direction.

Swing Trading (Crypto):

Swing Trading is a trading strategy in which traders take advantage of sudden movements in cryptocurrency prices. Cryptocurrency exchanges such as FTX, being open throughout the day, provide good opportunities for swing trading in cryptocurrencies.

If you are a swing trader, please do not forget to use multiple time charts, like a 1-day chart with 1-hour chart, to understand the fine reversals in advance.

For example, I am a day trader, so in stocks and cryptocurrencies, I use hourly charts. I use daily charts to learn the overall trend, and for understanding opportunities of fine reversal, I use 15 mins charts or 5-minute charts. This strategy has many times saved me money.

Crypto Pair Trading:

Crypto Pair Trading is a trading strategy in which two cryptocurrencies are exchanged with each other when one of them seems cheaper than the other. When the reverse occurs, with the first cryptocurrency being relatively more expensive, an opposite pair trade is performed.

Trading Bot

FTX provides free trading bots with full support for traders as integration on its platform. Click here to access trading bots.

Futures:

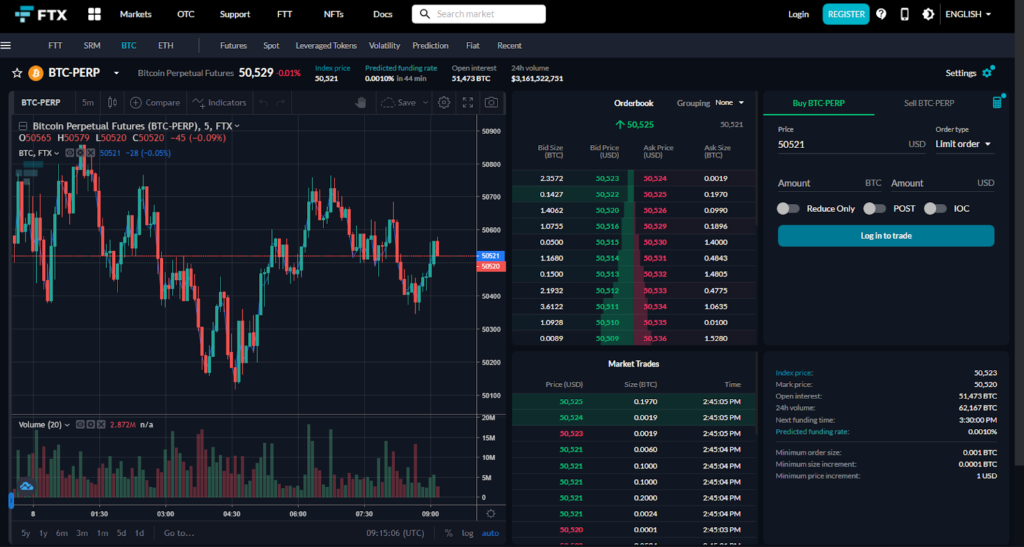

The futures section is the core of the transactions in the FTX Exchange. It accounts for the bulk of the trade amount, and just two futures: Bitcoin Perpetual and Ethereum Perpetual, occupy a major chunk of the traded value. Many other cryptocurrency futures are listed on the platform, such as Solana, Terra, Matic, XRP, SAND, etc. The futures section lists both monthly expiry futures as well as perpetual ones, with the latter being the most popular due to a lack of expiry date.

The indicators are a few of the best indicators for crypto trading. The screen seems sophisticated even for seasoned investors.

Spot

The spot is the place where the user can buy and sell cryptocurrencies using US Dollars, Brazilian Digital Tokens, Tether Coin, Euro, etc. The exchange rates are displayed as soon as one selects the base currency to trade. The screen displays Ticker, Name, past 24-hour volume, price, and daily change in percent.

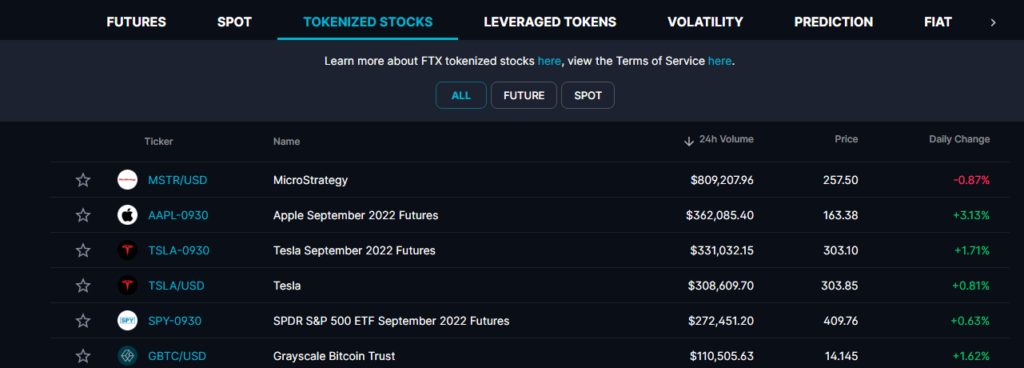

Tokenized Stocks

FTX is one of the exchanges where one can buy or sell stocks using cryptocurrencies. These are Tokenized Stocks, which means stocks are converted from the regular form into Tokens using blockchain technology. The exchange offers this feature in collaboration with CM-Equity, which also handles the KYC for those customers who want to trade Tokenized Stocks. These stocks are backed by real shares. Stocks, as well as stock futures, are listed here.

Leveraged Tokens

Leveraged Tokens are the tools that allow you to get leveraged exposure in cryptocurrency markets without having to bear all the clutter of leverage trading. It means you get to trade in much higher quantities(3x, 5x, etc.) as compared to your funds. The benefit of using a leveraged token is that you do not have to manually set different fields such as Leverage Ratio, Expiry Dates, etc.

For Example: If you have $50 worth of cryptocurrency, using a 3x Leveraged Token, you can make a trade up to $150. If you gain 10% profit on your trade, you will end up gaining $15 as compared to $5 in normal trade and similar for a loss.

FTX Bull and Bear Tokens

Bull tokens are a class of leveraged tokens where the direction of trade is fixed. If you expect the value of Bitcoin(BTC) to increase, you can use BULL TOKEN instead of buying bitcoin manually and keeping it in your wallet. A Bull Token is used when the price of a certain asset is expected to increase.

For Example: If you are optimistic regarding the price of Bitcoin and wish to gain a 3x leverage on it. And let us suppose you want to trade for $100. Then:

- Buy Bit Bull/USD (for trading with US Dollars).

- Transfer $100 to Bit Bull Account on FTX. Since you are using 3x leverage, you get to trade $300 worth of bitcoins.

- Suppose you gain 10% on your trade and wish to close the trade. You stand to gain $30.

- Next, to get the money($30), you need to send $330 dollar worth of Bitcoins to FTX from Bit Bull Account.

- FTX will destroy the leveraged tokens and return you $130 ($100 initial trade value and $30 Profit). This money will get deposited in your FTX account.

Similarly, you can also trade when you expect the value of a certain coin to go down. That token is called a BEAR TOKEN. It is exactly the same as a Bull Token but acts in the opposite direction (acts downside).

For more on Leveraged BULL and BEAR Tokens: Visit Leveraged Trading

How does crypto leverage trading work?

FTX allows the user to select different leverage ratios, both for longs and shorts. The cryptocurrencies used for trading need not be paid in full, but partial payment is required. Important to note that a user should consult a financial expert before taking any trade decisions.

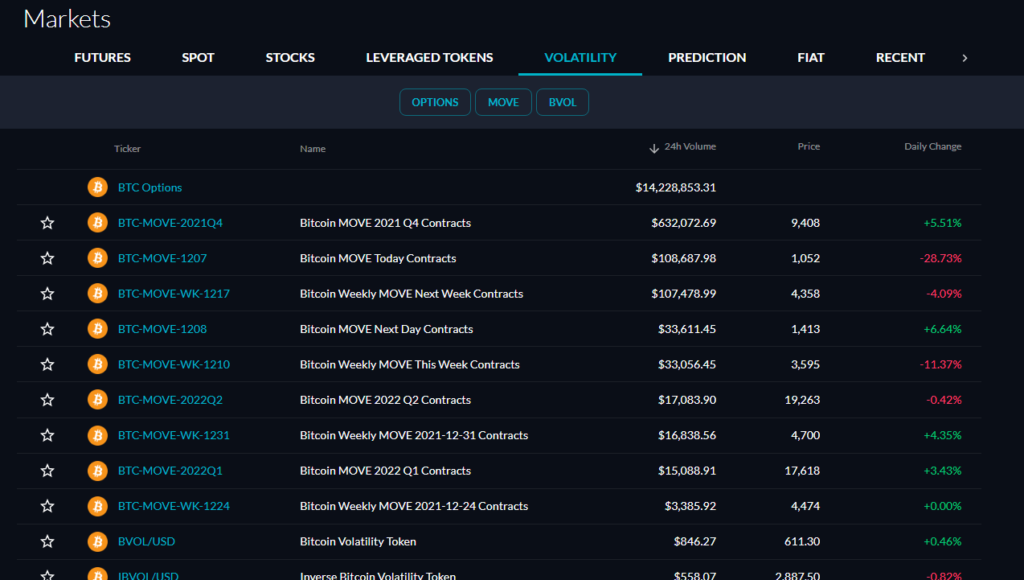

- Volatility:

Volatility shows how much a future or options contract has changed value over a period of 24 hours. Besides, it shows the price and the 24-hour volume. Volume is the number of trades(a buy and corresponding sell) that took place. There are 3 options to select or deselect a category: Options, Move and BVOL. Options here are similar to stock options, Move is the movement of Bitcoin Future Contracts, and BVOL is the Bitcoin Volatility Token.

Prediction

The prediction here means betting on election results. It has only two listings currently but can potentially list more in the future, depending on the platform’s popularity and betting. The analysis screen is complex and can intimidate new users.

Note: One of the Core Applications of Blockchain Technology is Betting. Since betting is mainly regulated via cash or fiat currency. Cryptocurrencies and high technology can help regulate this field.

Fiat Trading

As of now, only the Canadian Dollars and Euro are listed among Sovereign Currencies contracts, with US Dollars acting as a medium of exchange. It is interesting to note that the Brazilian Digital Token and Tether are also listed as FIAT. Tether has both expiries as well as perpetual future contracts listed as FIAT. The most traded contract here is the tether coin, with an overwhelming stake.

Advanced Trading

The advanced trading section is a personal favourite of mine as it helps me plan all the trade strategies. I can easily use different indicators to analyze the potential of my trade which allows me to avoid false trades based on hype and helps me retain my profit.

FTX Card

FTX card is a VISA debit card that lets you spend your crypto directly from your FTX accounts. There are no fees associated with this card.

This card is not available in India, and it would definitely be a good thing if it came here.

Over The Counter (OTC):

Over The Counter markets in cryptocurrencies are similar to the traditional finance ones. Here, the two parties agree to exchange cryptocurrencies based on mutual agreement, and the platform just plays a place for exchange. It is also called P2P Trading.

Please note that if you are Indian trading in international crypto exchanges, do not forget to conform to the 1% TDS Tax on Crypto.

Platforms charge very minimal or zero fees for such exchanges.

FTX has a separate portal for OTC exchanges. The portal can be accessed by clicking here. The user can use the same FTX account for this portal too.

FTX Token:

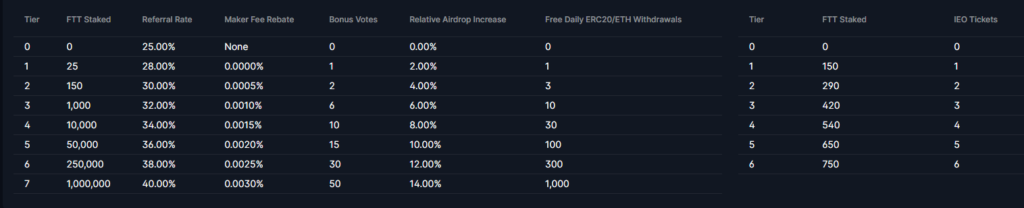

FTT, or The FTX Token, is the cryptocurrency token of FTX. It is said to be the backbone of the FTX ecosystem. Currently, 352 million FTT are minted. The current supply is 134 Million tokens totalling a net of over $3.7 billion. FTX gives fee rebates of around 3 to 60% if the user holds FTTs from 25 to 1 million.

FTT Staking is yet another feature of FTX, which allows users to get further rewards in terms of FTTs or NFTs for staking (a term used for crypto fixed deposits) their FTTs.

Non-Fungible Tokens (NFTs):

Non Fungible Tokens are digitally non-interchangeable (i.e., non-fungible) data stored in blockchains. These can range from a wide variety of Photos, videos, 3D Designs, Music, Artwork, etc. The past year has seen the rise of NFTs in leaps and bounds. These digital assets are being sold for thousands of dollars.

FTX, being a major cryptocurrency exchange, has a well-developed NFT platform. It has a wide range of collections from Clothing Art, Geometrical Figures, Bored Ape NFT, etc. The entire platform is quite rich in variety. Even if I do not buy NFTs, I spend a good couple of hours each month browsing them.

7 Benefits of FTX Staking

FTX presents a unique way of zero-charge trading and cryptocurrency investing through the staking of FTX Token. The idea is simple; you need to buy some FTX Tokens and then stake them. The rewards for staking are as follows:

- Increased bonus when you refer FTX to someone.

- Fee rebates in case you are a MAKER.

- Free SWAG NFTs.

- Bonus votes in FTX voting. This is a fun event where supporters of different cryptocurrencies vote against their competitors.

- Increased Airdrop Rewards.

- One free fiat withdrawal per week.

- Waived fees when you transfer your ETH and ERC-20 Tokens.

The above benefits are clearly described in the image in a quantitative fashion.

The more you stake FTX, the more rewards you get.

Though the FTX staking is predominantly used to stake FTX Tokens, it also supports three more cryptocurrencies such as:

- Solana(SOL): Staking SOL on FTX lets you earn a reward of 6% APY. It takes 7 days to unstake SOL.

- Serum(SRM): Serum Token of the Serum Ecosystem offers 4% APY rewards. However, 2% (half of the rewards) are locked and cannot be sold immediately. It takes 7 days to unstake SRM.

- RAY: It offers 20% staking rewards per year that can earn you a decent passive income in cryptocurrencies. However, you should always stay cautious and avoid cryptocurrencies that promise unreasonably high rewards. It takes 7 days to unstake RAY.

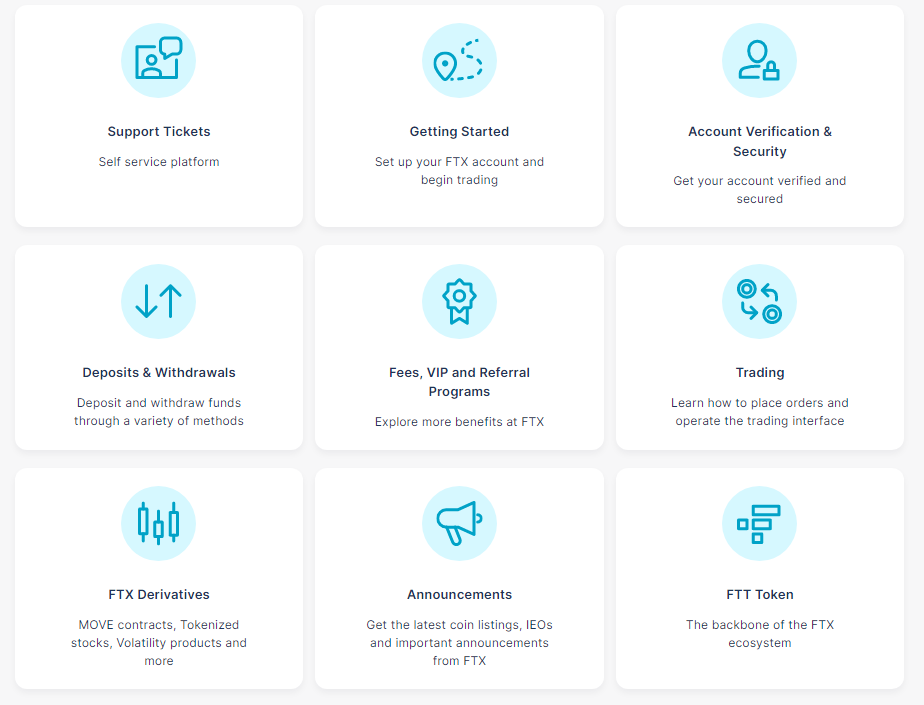

Docs:

FTX has a self-help page for frequently asked questions. The page can be accessed by clicking here. The page provides detailed information on the following:

- Account Setup

- Account Verification and Security

- Deposit and Withdrawals

- Fees, VIP and Referral Plans

- Trading

- Derivatives

- Announcement

- FTX Token

The page has been designed keeping the most common problems faced by users in mind. Overall navigation and appearance are kept as simple as possible to make users feel comfortable with the usage of the platform. There is also a link to submit a request if the issue cannot be resolved using the above help.

Conclusion:

The FTX seems quite a capable platform. Having a good amount of tools and indicators on board with a simple user interface is good for both novices as well as experienced traders. The platform has one of the best self-help resources. The market share and number of users are self-evident of its quality. NFTs featured on the platform are in various types and categories. Overall our view of the platform has been very much satisfactory.

Frequently Asked Questions:

Is FTX good for beginners?

Yes, FTX is good for beginners as well as seasoned traders. The beginners might get intimidated by the host of features, but these are easily understood. Moreover, there is community and customer support available.

Do peer-to-peer transactions have zero cost?

FTX does not charge for peer-to-peer transactions. However, a gas fee is to be paid for transactions. The gas fee is an integral part of any blockchain.

How to reduce/eliminate the transaction fees on FTX?

FTX provides a prepaid option for transaction fees. You need to buy 25 FTTs to make the transaction costs zero.

How do I sell NFTs on FTX?

FTX provides an option for NFT creators to list their art on FTX. This service is not available for users in the USA. For more details, visit: How to list NFTs on FTX?

How can I learn to place orders and advance trading on FTX?

FTX provides a tutorial on youtube about advanced trading. Please click this link to access those videos.

How do I get to know more about FTX?

FTX hosts a podcast on its youtube channel. The link can be accessed by clicking here.

7. What happens if I send tokens to the Wrong Address?

Please note that blockchain transactions are permanent, meaning a token sent to the wrong address cannot be recovered. So please make sure to verify twice before sending any funds from FTX or to FTX.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.com/id/register?ref=T7KCZASX