Bitcoin has broken its past 52-week low and has reached $15,600. The prices are expected to fall further due to market weakness. Bitcoin Investment Analysis shows that there is further room for a greater fall. Further, On-Chain data shows weak fundamentals, which means there is little to no chance of recovery as fewer people have been using Bitcoin recently.

Bitcoin Analysis

Technical Analysis

Bitcoin broke its 52-week low amidst the DCG-backed Genesis Trading crisis. It also broke down from a symmetrical triangle pattern showing extreme upcoming weakness.

- RSI is at 30, so it’s not oversold yet. This means there is more room for selling.

- MACD shows divergence, which also indicates further downside.

- Volume is increasing on the seller side.

Overall, Bitcoin shows a very weak near future in terms of technical analysis.

On-Chain Analysis

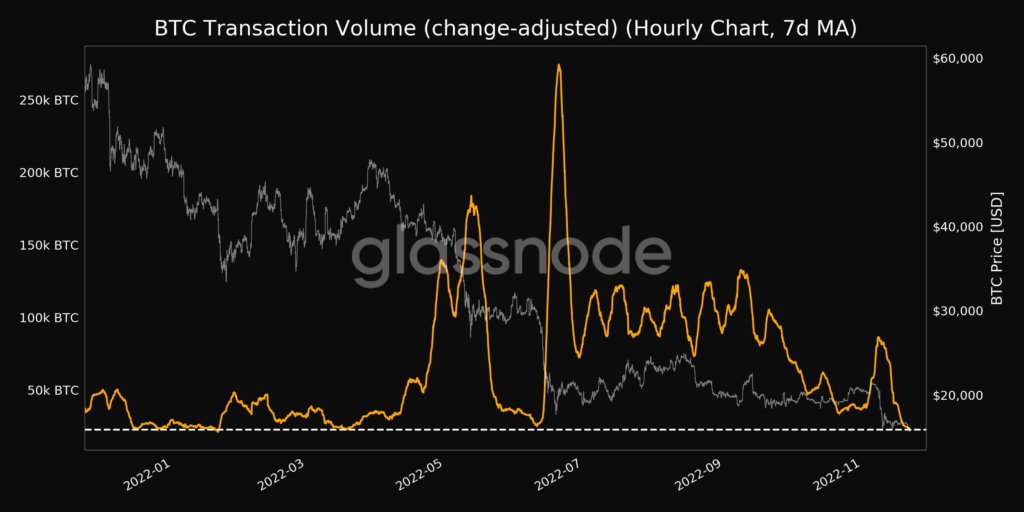

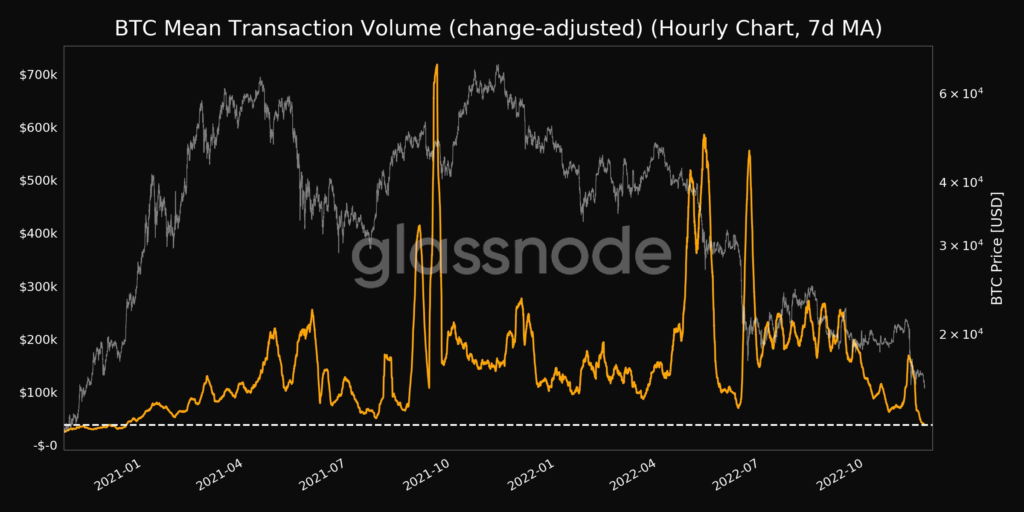

On-Chain analysis shows Bitcoin is losing its user base.

Analysis shows Bitcoin Transaction Volume just reached a 10-month low.

The mean transaction value reached a 23-month low. This shows people are turning away from Bitcoin as a means of payment.

Target and Stoploss

The current fall is below the 52-week low, and it can easily fall below $14,000. For those who are shorting it, keep a 10% stop loss of your trading capital since this appears to be a rare opportunity for short positions.

Should I average?

For those who are investing for the long term, it is an attractive opportunity for them to buy and average their past investments. However, since there is room for further fall, investors can put their money in small installments, not lumpsum.

For new investors, it is better to stay away as markets will be volatile for some time. Small traders and investors can start once markets recover above $20,000.

Conclusion

Bitcoin is and will start the topmost crypto. The current fall is from an event-driven scenario of exchange collapses. Once these events are over, we can expect a decent recovery up to $18,000.