Recently we showed how Ethereum ownership was at an all-time high, with more than 90 Million non-zero wallets. Recent data shows similar trends for Bitcoin as well. There has been a record hoarding of top cryptocurrencies. Much of these Bitcoins are being taken out of the exchanges following FTX Collapse. Further, low transaction volume shows these investors are in for the long haul.

Bitcoin On-Chain Data shows increasing Long-Term Investors

It is a well-known fact that whales have bought Bitcoins for quite a while in the crypto winter. Cathie Wood of Ark Invest has continually bought Bitcoins or Bitcoin ETFs despite price crashes. Further, whales have now started buying aggressively as the BTC price plummets.

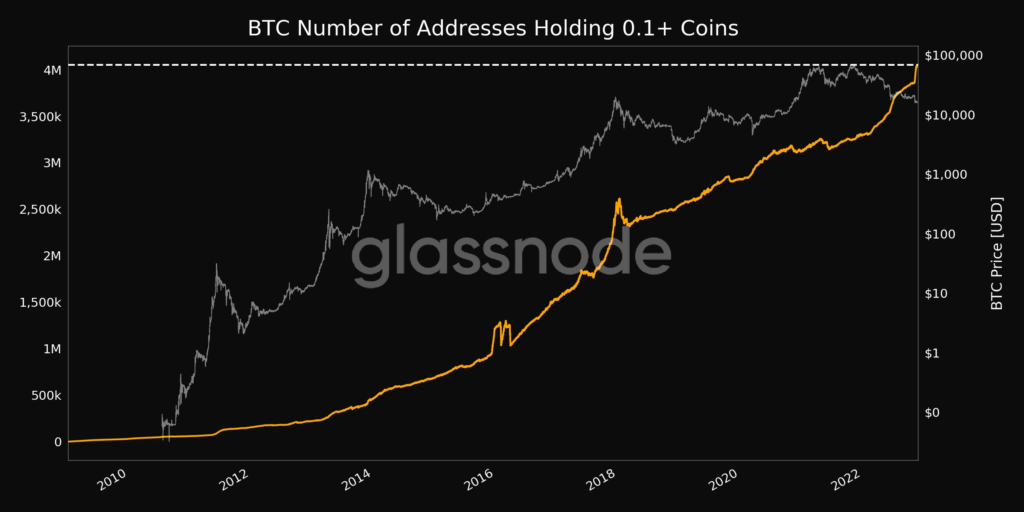

We have analyzed on-chain data for the number of wallets holding small amounts of 0.1 BTC, which is our threshold for considering a serious investor.

The small investors have made a record high number of more than 4 Million BTC addresses. These figures suggest that Bitcoin is broadening its user base, a critical factor for mass adoption.

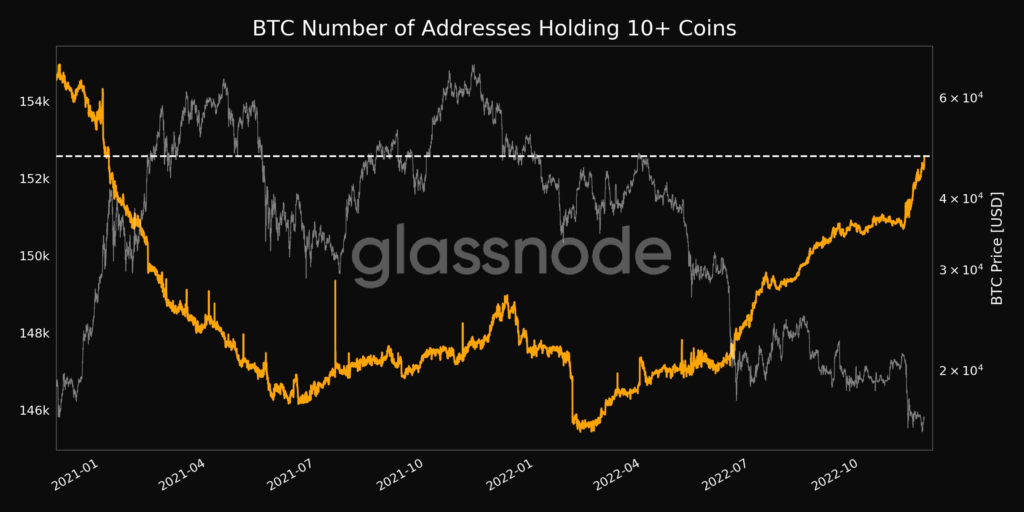

We also have analyzed wallets that hold more than 10 BTC(our threshold for big wallets) or about $160,000+ at current price levels.

The big wallets have accumulated BTC since the beginning of the crypto winter. Wallets that contain more than 10 BTC are at a 22-month high at 152,575 addresses. These suggest that majority of those who own BTC are long-term investors despite the fact that about 50% of holders are in some kind of loss.

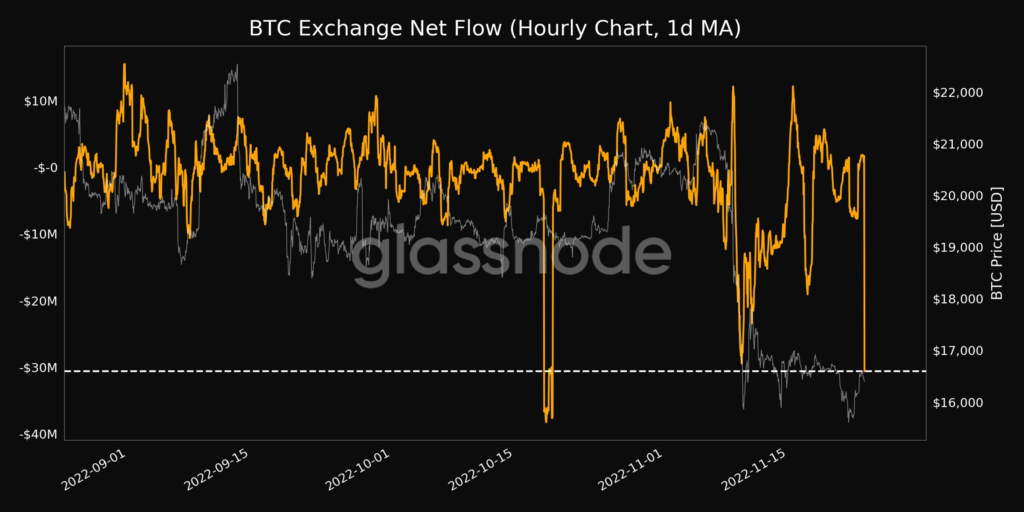

Bitcoin Exchange Data

Exchange data shows that a large number of holders are rapidly taking their deposits off the exchange. This outflow increased in November after the FTX Collapse. On November 24, the net exchange outflow reached $30.5 Million on an hourly basis. This figure was highest for the past 1 month.

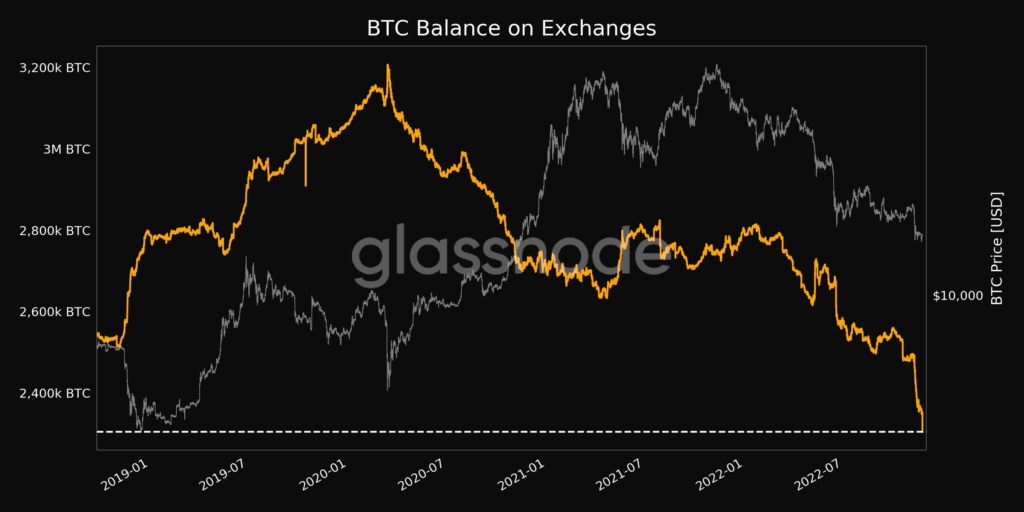

The Bitcoin balance on exchanges is also at a 4-year low signifying a weakening investor trust in exchanges. Since FTX’s collapse, many large exchanges have shown some kind of proof of their crypto reserves. The names include Binance, KuCoin, Bitfinex, Bybit, etc. Currently, all exchanges put together have a total BTC balance of 2.304 Million. This data excludes exchange reserves which are kept in cold storage.

Conclusion

Investors accumulated Bitcoin as prices fell. The wallets which hold more than 0.1 BTC are at a record high of 4 Million wallets. Further, the number of BTC holders with 10+ coins is also at a 22-month high. Most of these holdings are outside exchanges as the FTX collapse drives fears of further exchange capitulations. Exchange BTC balances are now at a 4-year low of 2 Million BTC.

All of these data assure that Bitcoin is nowhere to go. People acted smartly by accumulating it and holding their BTC for the long-term.

I think this is one of the most important

info for me. And i am glad reading your article. But should remark on few general things, The website style is great, the articles

is really excellent : D. Good job, cheers

[…] is a trend of holding crypto in your own wallet these days after a major exchange, FTX, collapses. However, there is also a need to understand […]

[…] conference takes place at a time when there has been record Bitcoin accumulation by all kinds of […]

[…] Bitcoin 2022 conference taught me the importance of on-chain analytics which helped me detect the 40% rally(Jan 2023) a couple months in […]

[…] Also check out: On-Chain data shows Investors hold Bitcoin in record numbers but off-exchanges […]