Clouds of doubt emerged over Binance as the exchange could not process USDC withdrawals. This incident raised doubts about its liquidity crunch or, worse, about its insolvency. To make matters worse, Binance has a ton of subsidiaries that essentially help the entire crypto markets function properly. Two of them are CoinMarketCap and Trust Wallet. Over 25 million users are currently using the trust wallet, including me.

In a hypothetical event, if Binance collapses, is your crypto safe in the TRUST WALLET?

Finally, we shall also see if there is evidence of Binance being in trouble.

Trust Wallet

Trust wallet is a multi-coin cryptocurrency wallet with more than 25 million users. Binance acquired Trust Wallet in 2018. Therefore, any crisis in Binance is liable to affect Trust Wallet as well.

There is a trend of holding crypto in your own wallet these days after a major exchange, FTX, collapses. However, there is also a need to understand which wallet can keep your crypto safe and which cannot. Trust wallet is one of the commonly used hot wallets and might be the first choice of several users.

Is Binance safe?

The survival of any company is much more than its monetary solvency. Companies like Ruchi Soya have gone insolvent and yet have been successfully restored to past glory. This survival depends on many factors, such as:

- Net Assets and Liabilities

- Leveraged Debt

- Legal Commitments, Prosecutions, and Litigations

- Status of the Industry

Prima Facie, Binance is safe!

The Fear, Uncertainty and Doubt(FUD) around Binance started when there was a news that Binance could not process USDC withdrawals. The situation gave wind to doubts that Binance was facing liquidity crisis since Binance already has lower amount of USDC as compared to USDT.

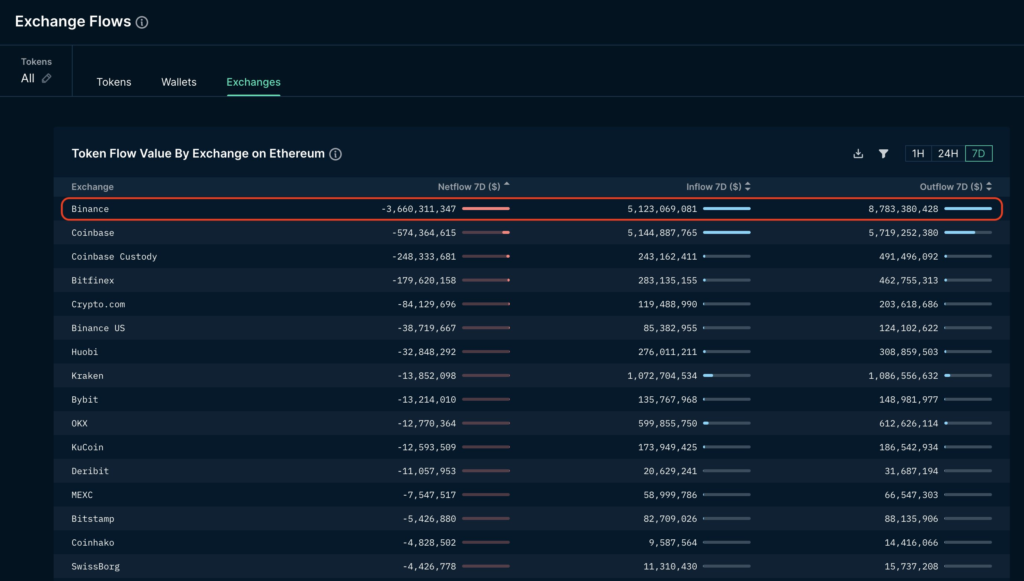

Binance has reserves worth around $48 Billion. The reserves are 5 times of the daily trading volume as on Dec 20, 2022. Further, during the week where net outflow from Binance was the highest, it witnessed around $3.6 Billion being withdrawn from the exchange. Below is the Nansen Dashboard as of Dec 13, 2022 showing outflows in the preceeding 7 days.

Also, on the day when maximum outflow took place, the amount was around $2 Billion. Around 24 times lesser than the total reserves held by Binance.

However,

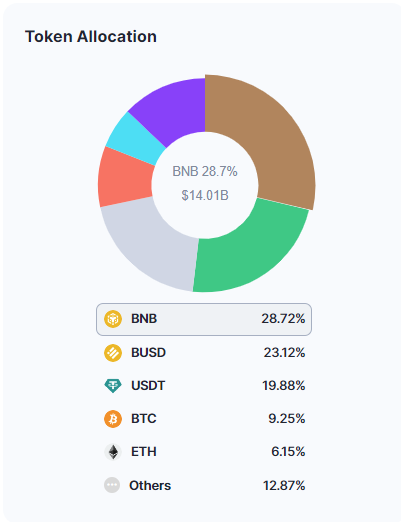

A majority of the reserves are in the form of internal tokens like BUSD and BNB. BUSD is a bank-verified stablecoin and claims NYDFS approval. However, BNB has a floating value and was recently volatile when there was speculation on Binance’s liquidity.

The major reason why FTX collapsed was that it used its native token, FTT(floating value), to create collateral and used them as reserves. Internal tokens are not solid proofs of reserves as they can be minted upon will. Another major collapse of an ecosystem was due the infinite mint of $LUNA, internal token of the Terra ecosystem.

Even if we neglect the BNB reserves, the stablecoin reserves are more than 43% ($20 Billion) of the net reserves. Further, crypto reserves of just Bitcoin and Ethereum together make around additional 15.4% of the net reserves($7.4 Billion). These reliable cryptocurrencies are together around $27 Billion in value. Any bank rush on Binance should be comfortably addressed by such reserves.

What happens to Trust Wallet if Binance collapses?

It might be naive to assume that any liquidity or solvency crisis in Binance won’t affect its subsidiaries. Trust Wallet being a subsidiary of Binance would surely find it difficult to continue in such situation. However, currently it seems that such a situation might not appear at least in the near future.

What should I do now?

There are several ways to secure your holdings. Since insured custodial services are not available for small and retail investors like us, it is better to use the options currently available.

Distribute your Holdings

The best way to secure your cryptocurrencies is to distribute your portfolio over a few wallets.

For funds that you need daily, use hot wallets like MetaMask or any other similar wallet. You can also use Trust Wallet and explore other options, such as Coinbase Wallet or Math Wallet.

Use hardware wallets to store your reserve crypto. Only choose the most popular one, i.e., Trezor or Ledger. Since both of them are industry leaders, it is unlikely that they will go out of business unless they are doing some shady stuff like FTX. Be careful not to cause any physical or electronic damage to the wallet, as you may lose your funds forever.

Conclusion

Trust Wallet is safe for now. But, crypto markets are going through tough situations. Major exchanges and DeFi companies like FTX, Voyager, etc., have fallen. You must secure your hard-earned funds, and to do so, and I suggest you rely on multiple wallets instead of one. Trust Wallet currently seems to be a secure option but seeing the volatility in the industry, and it is best to use a combination of hot and cold wallets, which can provide greater safety.